Navigating the Corporate Transparency Act in 2024: A Guide for HR Professionals

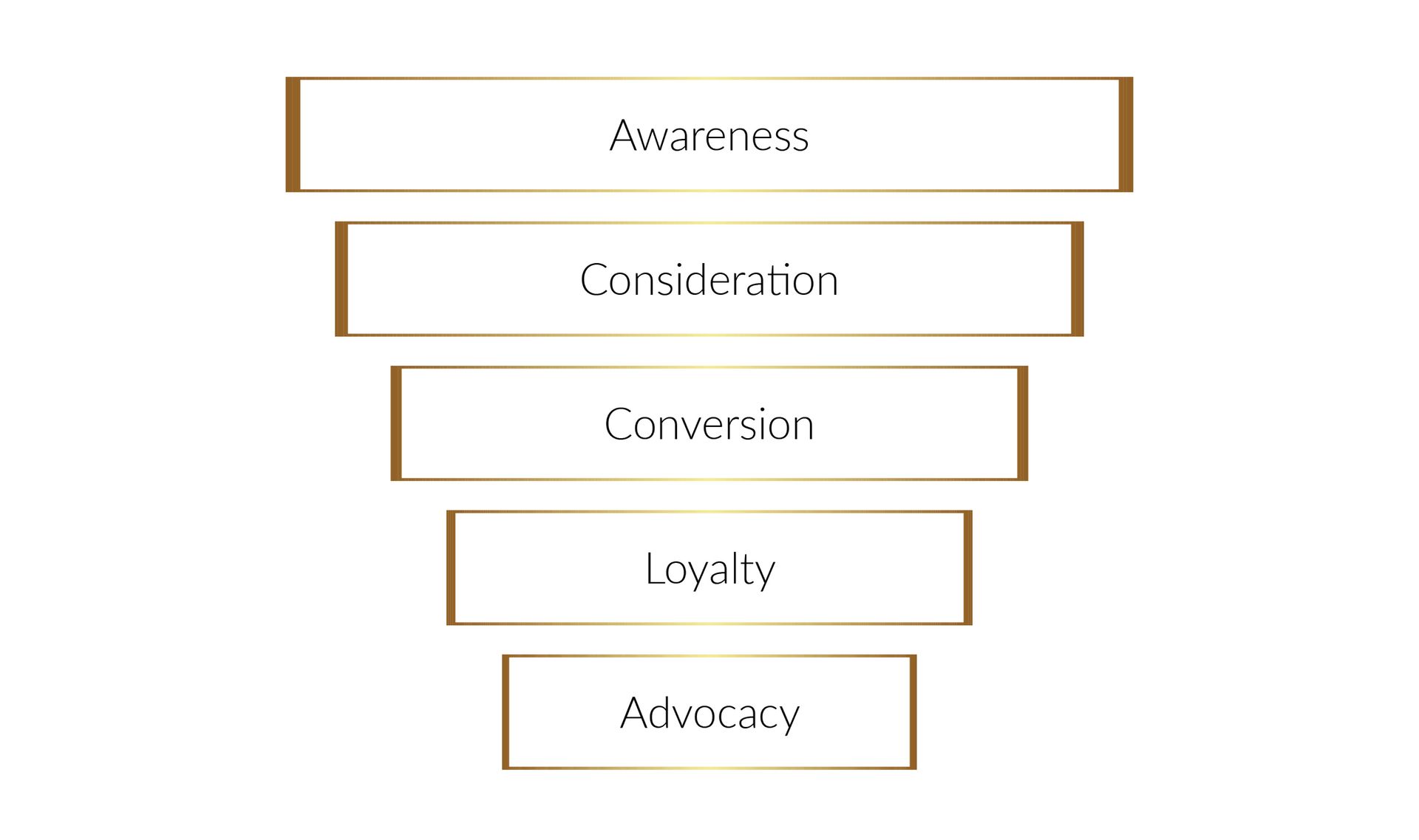

Actionable Steps for HR Professionals

As we step into the new year, Human Resources (HR) professionals are gearing up for significant changes with the implementation of the Corporate Transparency Act (CTA). Enacted to enhance transparency and curb illicit activities, the CTA places new reporting requirements on businesses. In this blog, we'll explore what HR professionals need to be doing in 2024 to ensure compliance with the CTA.

Understanding the Corporate Transparency Act:

Before delving into specific actions, let's have a quick refresher on the key aspects of the CTA. This legislation, effective from January 1, 2024, mandates certain businesses to file Beneficial Ownership Information (BOI) reports with the Financial Crimes Enforcement Network (FinCEN). The goal is to identify individuals with substantial control over companies, beneficial owners with at least 25% ownership interests, and those influencing critical decisions.

Actionable Steps for HR Professionals:

Educate Your Team:

Ensure that your HR team is well-versed in the requirements of the CTA. Familiarize them with the definitions of beneficial ownership, substantial control, and other key terms. This foundational knowledge is crucial for accurate identification and reporting.

Review Existing Policies:

Take a close look at your organization's existing policies related to ownership disclosure and reporting. Update these policies to align with the CTA's requirements. Clarify procedures for reporting changes in ownership or control and communicate these changes to approperiate employees.

Identify Reporting Obligations:

Work closely with legal and compliance teams to determine which entities within your organization are subject to CTA reporting. This may involve assessing the ownership structure, identifying beneficial owners, and understanding exemptions.

Implement Training Programs:

Conduct training sessions for relevant staff, especially those involved in ownership or operational changes. Provide clear guidance on recognizing scenarios that trigger BOI reporting, such as changes in leadership roles or substantial control.

Collaborate with Legal and Compliance:

Establish open lines of communication with your legal and compliance teams. Regularly consult with them to stay updated on any regulatory changes or interpretations related to the CTA. This collaboration ensures a unified approach to compliance.

Update Onboarding Processes:

Integrate CTA compliance into your onboarding processes for new hires. Collect necessary information from employees who may qualify as beneficial owners or individuals with substantial control. This proactive approach helps streamline future reporting.

Establish Record-Keeping Protocols:

Develop robust record-keeping protocols to maintain accurate and up-to-date information on beneficial ownership. This includes creating systems to track changes in ownership, control, and other relevant details.

Stay Informed about Reporting Deadlines:

Keep track of reporting deadlines for initial and updated BOI reports. Missing deadlines can lead to penalties, so it's crucial to stay vigilant and ensure timely submissions.

Conclusion:

As HR professionals gear up for the challenges of 2024, a proactive and collaborative approach to CTA compliance is key. By educating the team, updating policies, and staying informed, HR can play a pivotal role in ensuring that their organizations adhere to the new reporting requirements, fostering transparency and integrity within the business landscape.