Demystifying Open Enrollment for Health Insurance: A Comprehensive Guide

Navigating the Annual Benefit Decision Journey with Confidence

Open enrollment for health insurance 2023 is just around the corner, and it's a critical time for both employees and employers. This annual event offers a unique opportunity for employees to make changes to their benefit plans, ensuring that they align with their evolving needs. Let's delve into what open enrollment entails, how to conduct a successful campaign, and ways to engage employees effectively during this crucial period.

Understanding Open Enrollment:

Open enrollment is a designated period during which employees can make changes to their benefit plans, including health insurance, for the upcoming year. This period typically happens only once a year and serves as a window of opportunity for employees to select, modify, or cancel their benefit choices. It's a crucial time for them to assess their healthcare needs, consider life changes, and make informed decisions.

How Open Enrollment Works:

During the open enrollment for health insurance 2023, employees receive information about available benefit options and any changes to existing plans. They can then review these options, compare coverage, and decide which plans best suit their individual and family needs. Changes made during this period usually take effect at the start of the following year.

Running a Successful Open Enrollment:

- Communication is Key: Start by providing clear and comprehensive communication about open enrollment dates, available plans, and any changes. Use various channels like emails, company intranet, and informational sessions to ensure employees are well-informed.

- Organize Your Materials: Compile all necessary documents, including plan summaries, cost breakdowns, and FAQs. Present this information in an easily accessible format to facilitate decision-making.

- Personalized Assistance: Offer one-on-one sessions or a dedicated helpdesk where employees can get their questions answered by benefits experts.

Getting Employees Excited and Engaged:

- Create a Buzz: Build anticipation by using teasers and countdowns to the open enrollment period. Highlight the value of benefits and the positive impact they can have on employees' lives.

- Tailor Communication: Craft messages that resonate with different employee demographics. Highlight specific benefits that cater to various life stages and needs.

- Gamification: Turn the process into a game by incorporating quizzes, challenges, and rewards for participation. This can make the experience more interactive and enjoyable.

Purpose of Open Enrollment Meetings:

Open enrollment meetings serve as a platform to provide in-depth information about benefit options, changes, and important deadlines. These meetings offer employees an opportunity to ask questions, clarify doubts, and receive personalized guidance from benefits experts.

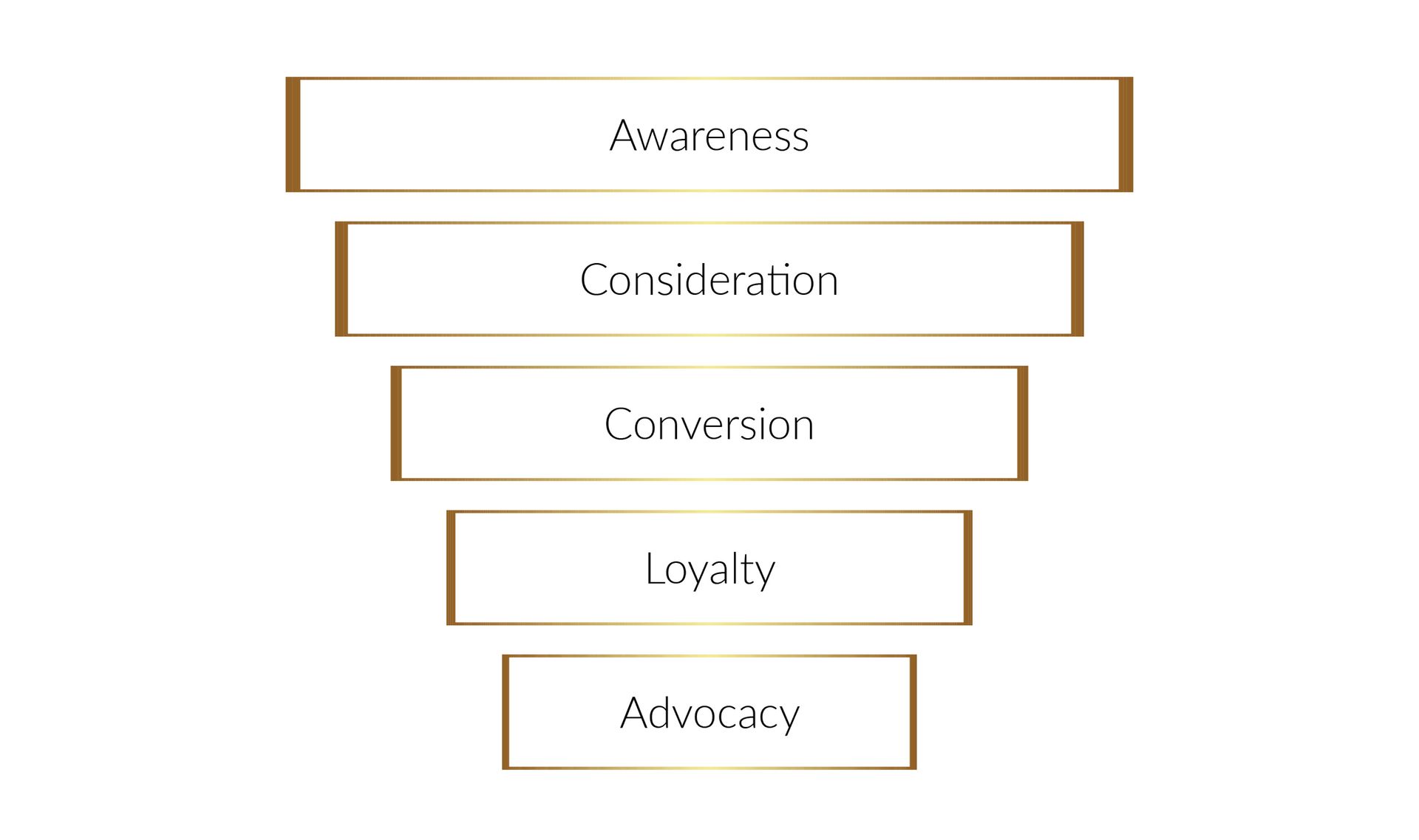

Stages of Open Enrollment:

- Preparation: Gather all necessary materials, update information, and create communication plans.

- Announcement: Inform employees about the upcoming open enrollment period, highlighting key dates and available resources.

- Education: Provide comprehensive information about benefit options through various channels.

- Decision-Making: Give employees ample time to review plans and make informed decisions.

- Enrollment: Allow employees to select their preferred benefit choices within the designated period.

- Follow-Up: Address any post-enrollment inquiries and assist employees who may have missed the deadline.

Open Enrollment Ideas:

- Benefits Fair: Organize an event where employees can meet with benefit providers, ask questions, and learn about available options.

- Wellness Incentives: Tie open enrollment participation to wellness initiatives, offering rewards for engagement.

- Video Campaigns: Create short videos that explain benefit options and showcase real-life scenarios.

- Interactive Webinars: Host webinars where employees can interact with benefits experts and get real-time answers to their questions.

Open enrollment for health insurance 2023 is a crucial period that empowers employees to make informed decisions about their benefit plans. By fostering clear communication, personal engagement, and creative approaches, HR professionals can ensure a successful and meaningful open enrollment campaign. Remember, this annual event is an opportunity to enhance employee well-being and demonstrate a commitment to their overall health and satisfaction.

Stay tuned for more insights and practical tips as we approach the open enrollment season!